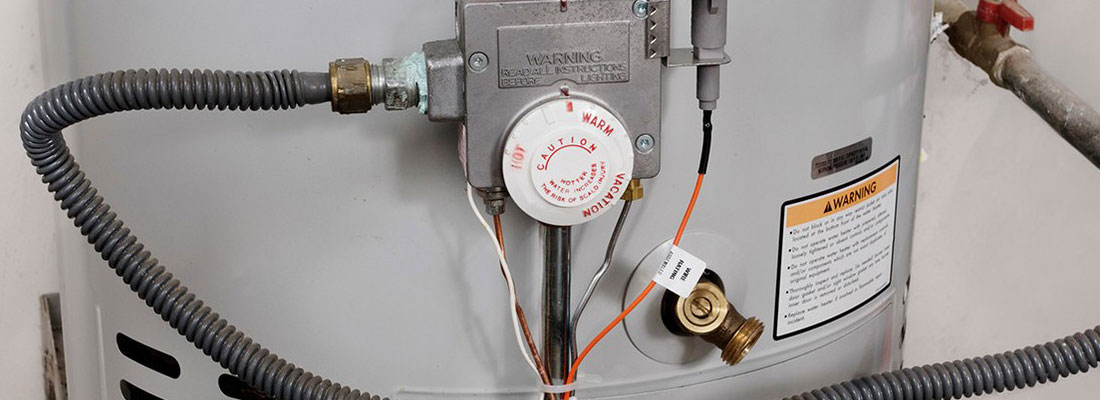

This could be the most dangerous appliance in your home

Believe it or not, one of the most important appliances in your home – your water heater – also has the potential to be the most dangerous. That’s why it’s so important to make sure it is well maintained.

Water heaters have a thermostat designed to monitor and prevent super-heating. If the thermostat fails, a temperature and pressure relief valve (TPRV) is installed to relieve the pressure. The TPRV is that little metal lever you see on top of your water heater.

A water heater can accumulate more than 85,000 pounds of pressure. If the tank ruptures with super-heated water inside, and there’s no TPRV, the result is a severe explosion. So protect your home. Double check to make sure your water heater has a TPRV.